Answer: you can dispute any item on your credit report that you believe contains an error. As simple as this may sound, recognizing the many ways a report error could occur can be tricky. This article contains a list of common report errors that may require a dispute.

Items you can dispute on your credit report

Errors do not belong on your credit report and can be disputed. However, report inaccuracies are not always black and white. In fact, errors can show up in many forms. When reviewing your credit report, be on the lookout for any of the following items. If one or more of these variations are listed, you could have a case for a credit dispute.

- Inaccurate payment activity. Does your report show a late or missed payment that you know you made? If you have the proof to back it up, inaccurate payment activity could be disputed.

- Duplicate item. This can occur if an account or any information is listed on your report more than once.

- Incorrect amount. If you owe $1,000 on an account but your credit report says you owe $2,000 (or any amount that is not accurate), it could be an error.

- Item over the statute of limitations. Depending on the state you live in, items can stay on your report for 7 years or more. If an item is still on your report after this threshold passes, you could have a disputable case on your hands.

- Mistaken identity. See an account that you didn’t open? Perhaps the name is correct but the account is not? If this is the case, it may be the result of mistaken identity.

- Fraud. Any financial activity or accounts opened without your knowledge could fall into the fraud category and can be disputed.

How often do credit report errors occur?

According to CBS News, 4 out of 5 credit reports contain at least one error. Errors can land on anyone’s credit report. Even if you’re responsible with your finances, it won’t always protect you from credit report errors.

Do credit report errors really matter?

Yes! If left to chance, report errors could severely damage your credit. Depending on the amount and severity of the inaccuracy, it could drop your scores and even prevent you from obtaining a new line of credit. Moreover, report errors could be the difference between getting approved or denied for a mortgage, auto loan, credit card, or any item that requires a credit check. In addition to approval, a report error could also impact the terms and interest rate you may be offered.

How do I know if my credit report contains an error?

The best way to find out of your credit report contains an error is to review your report online. Scan each item and be sure to look at the facts, figures, and dates to determine if an error is present.Review My Credit Report For Errors

Why checking one credit bureau may not be enough

Did you know that lenders have a choice when it comes to which bureau they use to determine credit approval? In fact, some lenders may even pull your data from all three. You may be thinking, wait, shouldn’t my credit information be the same at every bureau? Unfortunately, that’s just not the case. This is because lenders also have a choice when it comes to which bureaus they choose to report your payment activity to. So even if one credit report is clean, the other two may not be so lucky – especially when it comes to errors. For best credit results, review your reports with Experian, TransUnion, and Equifax on a regular basis.

How to remove errors from your credit report

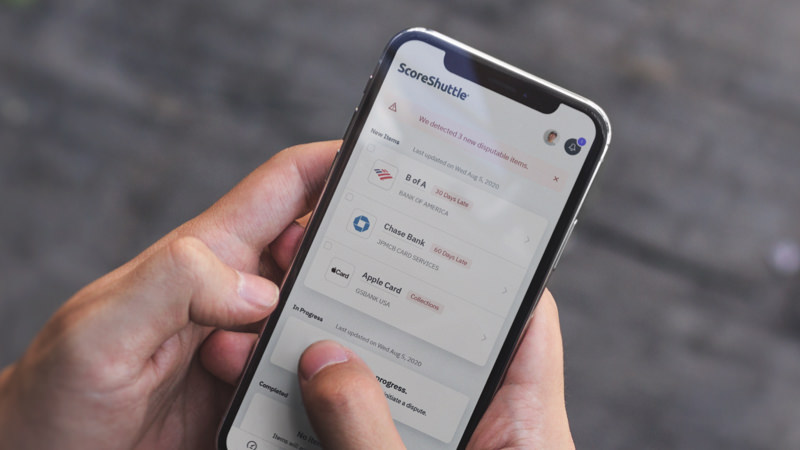

If you detect an error on one of your credit reports, your best chance for removal is to dispute it. You can file a new credit dispute either by hand or online. If you choose to file a dispute by hand, you’ll need to do some research before you begin. Dispute requirements such as what to include and where to send it may vary. Depending on how many bureaus contain the error, you’ll also want to make sure that your disputes are sent to each separately. But if you want to avoid the paperwork hassle, you can also file a dispute online. Software programs like ScoreShuttle allow you to file a dispute with one, two, or all three credit bureaus in just a few clicks.

Will disputing report errors impact my credit?

Yes! But likely is a good way. The act of sending a credit dispute alone will not impact your credit. However, if your dispute results in the removal of a harmful error, you will likely experience an increase in your credit scores. To learn more about the dispute process, including timelines on when you can expect results, click here.

Recap

You can dispute any item on your credit report that you believe contains an error. Items such as an inaccurate account or fraud could be categorized as an error and can be disputed. While disputing is your best option to potentially remove errors, the credit bureaus will have the final say. If your dispute results in the removal of a damaging error, you could experience a score boost.

Resources: [https://www.cbsnews.com/news/4-in-5-credit-reports-have-errors/].

Disclaimer: The content provided is for informational purposes only and not to give advice or guidance on credit improvement. Dispute removal is determined by the credit bureaus and is not guaranteed. ScoreShuttle does not review, approve, or remove disputed items from credit reports.